Primary factors insurers use

Insurers set green slip prices and State Insurance Regulatory Authority (SIRA) regulates those prices. Insurers use different factors and apply different weightings to these factors to set the premiums they will charge.

Certain primary factors used by insurers affect green slip prices.

| Primary factors used by insurers | |

|

Driving history:: |

|

|

|

|

|

|

|

Claims history: |

|

|

|

|

SIRA designates geographic (rating) regions and vehicle classifications.

There are five geographic (rating) regions:

- Sydney Metropolitan

- Outer Metropolitan

- Wollongong

- Newcastle/Central Coast

- Country.

Insurers are not allowed to differentiate on the basis of locality within a rating region.

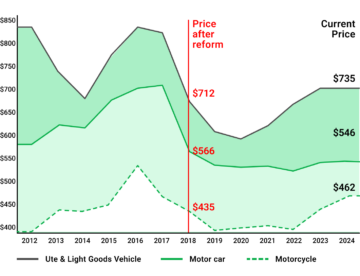

In the past 12 years, green slip prices have varied considerably. This makes it more important than ever to compare prices.

Average green slip prices at June 2012 to 2024

|

At June |

Motor car |

Ute/LGV |

Motorcycle |

|

2012 |

$575 |

$843 |

NA |

|

2013 |

$616 |

$764 |

$437 |

|

2014 |

$608 |

$724 |

$429 |

|

2015 |

$662 |

$793 |

$447 |

|

2016 |

$689 |

$841 |

$535 |

|

2017 |

$695 |

$833 |

$465 |

|

2018 |

$566 |

$712 |

$435 |

|

2019 |

$535 |

$661 |

$406 |

|

2020 |

$531 |

$651 |

$412 |

|

2021 |

$535 |

$675 |

$414 |

|

2022 |

$521 |

$705 |

$405 |

|

2023 |

$541 |

$736 |

$439 |

|

2024 |

$546 |

$735 |

$462 |

How insurers work with SIRA

Insurers must first submit proposed premium filings to SIRA, setting out proposed premiums and supporting information. Insurers must submit premium filings to SIRA at least once a year. They may also submit a non-compulsory filing if they wish to vary premiums at other times during the year.

SIRA may reject a filing if it considers the proposed premiums:

- will not fully fund the insurers liability

- are excessive, or

- do not conform with its Premiums Determination Guidelines.*

As the regulator, SIRA must ensure the scheme is competitive and green slips are affordable:

- The scheme is competitive only if a sufficient number of insurers are motivated to participate.

- Insurers participate only if there is sufficient profit.

SIRA also operates a price comparison service, Green Slip Check.

* SIRA issues Premiums Determination Guidelines to regulate how greenslip prices are set. SIRA also regulates distribution and marketing of greenslips through the Market Practice Guidelines. Both are contained within the Motor Accident Guidelines 2017, available from SIRA.